In 2013, RAIN set out to discover what it was the Algoma district understood and expected from local farmers and food producers. After a series of surveys, visits to the farmers’ markets, interviews, and round-table discussions, RAIN uncovered some gaps between consumers in the Algoma District and producers. This note sheds some light on these gaps and some suggestions for future production opportunity.

Local as a definition varies from place to place, organization to organization. The Canadian Food Inspection Agency refers to local food as provincially grown. The Rural Agri-Innovation Network defines local as grown in the Algoma District. Beyond this, individuals will also have their own definition. What can be agreed upon, however, is local food has exploded as the latest trend. Unlike other fads such as skinny jeans and giant hairstyles, supporting local food really does deserve the buzz it’s getting. The growth in consumers looking for local food (whether it’s organic, sustainable, or just plain old local), has been increasing — and does not look like it’s going to decrease anytime soon.

In the North, growing has its own unique set of challenges. The Algoma District has such a huge variety of land where drainage, soil type, and climate pose challenges and opportunities for local farms. With extreme weather patterns from drought to flooding, and winters that can exceed 6 months or more, it takes a committed farmer to produce results. Local farmers also want to know that consumers will be there after harvest to purchase their goods. In 2014, local producers asked the Rural Agri-Innovation Network to find out what local consumers were looking for. Research was conducted and the results were very interesting.

The Research

In total, 270 individuals in the Algoma District, from Sault Ste. Marie to Thessalon, were surveyed about their spending habits, expectations from farmers, and their general concerns with respect to procuring local food. The results varied from product to product, and most discrepancies were based on what seems to be a lack of knowledge about local food and farming. The consensus is, however, that consumers want to keep their food purchased locally, with over 98% expressing this in the survey. Other stand out statistics is the demand for local fresh produce. Vegetables and fruits are at the top of the list, with 95 and 90 percent of consumers wanting these products to be made more available from local farmers in the future. Generally speaking however, the consumers’ purchasing dollars do not match their suggested demand for the survey’s list of local goods. In total, 70% of the survey group said that there are not enough places to purchase local food, and 49% said “product not in season” was a factor in preventing them from purchasing local food.

Furthermore, 86% purchase mainly during the summer months and a shocking 2% purchase local products during the winter. Of all the 270 participants, only 37 (15%) said they buy local all year round This provides some marketing opportunities for livestock and fruit and vegetable producers and/or processors with locally available foods in the off-season.

We conclude from these statistics that the general public is demanding more places to purchase local food, more flexible hours at markets or other locations, plus more awareness of seasonal availability for local products. For example, 48% of consumers said they would like to see more local milk available for purchase, while only 9% surveyed consumers currently purchase local dairy products. This number is surprising, as the Algoma District is home to one of the largest dairy producers in the north. Lock City Dairies has successfully entered the local grocery store market and offers local milk, butter, and ice cream for purchase. Another example is eggs: 85% of the survey group said they would like to see more eggs at the market, but only 39% of surveyed consumers actually purchase local eggs. This is also surprising because at least nine producers in the district sell their eggs, and locally graded eggs are available at every farmers’ market in the area.

Gaps in the Market

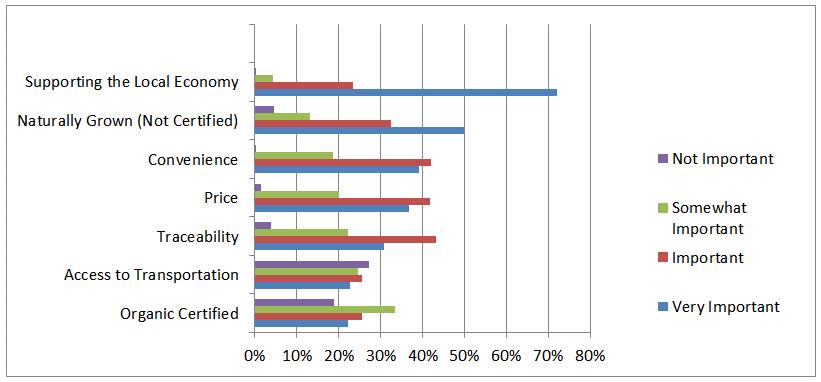

There are challenges and gaps for local producers to meet consumer demands. The items from the survey that showed the largest gaps were flour, bread, grains, and pork. There are few producers in the north who are growing grains and few processors who are milling local flour. Pork production appears to be decreasing each year and the vast majority of pork comes from large pork producers and processing facilities. These two areas show real potential for growth for local farmers and food processors. According to the Buy Algoma Buy Fresh directory in 2015, only three of 27 producers are involved with pork, and just one markets flour. The potential for growth in these areas is there, as producers are not meeting consumer demand. There is also a demand for more local fruit and higher volumes of poultry. It is very clear, however, that the most important factor to the consumer is that their money stays invested locally to stimulate the Algoma District economy (see Fig. 1).

Figure 1: “When purchasing local food, how important are the following ?”

?”

Farmer and Producer Involvement

Farmers and producers must play a bigger role in raising awareness of local consumers. This is what makes buying food from farm gate and farmers’ markets so valuable. Farmers have spent hours producing this food and know it intimately. Often, they will introduce new varieties of products. The key to long-term sustainable relationships between consumers and their food/food producers is to improve education of the consumer. Buyers need to know more about what is available and when, proper storage and preservation techniques, and how/where to buy their locally and seasonally produced goods.

Research Note – Understanding the Local Market: Results from a RAIN Research Study – Final PDF